A short era for worker power

Here are three of the week’s top pieces of financial insight, gathered from around the web:

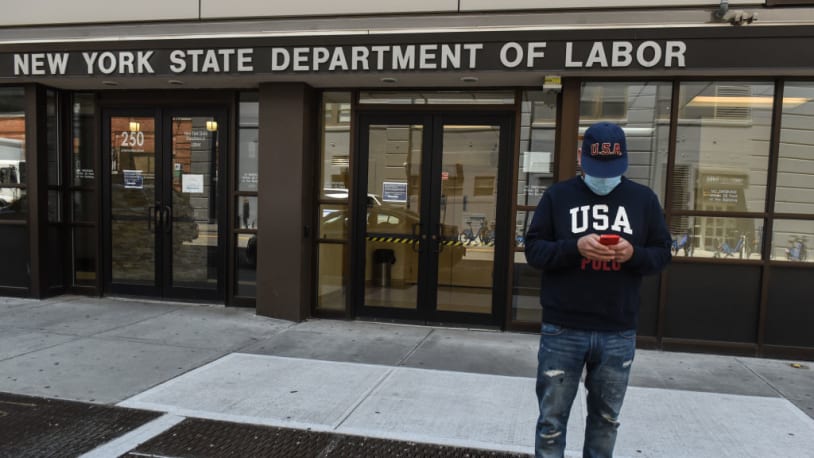

A short era for worker power

Workers feel their leverage is starting to slip away, said Callum Borchers in The Wall Street Journal. Stimulus checks, a soaring stock market, and remote-work flexibility contributed to an extraordinary amount of employee turnover during the pandemic, when the monthly “quits” rate — or the percentage of workers who resigned their positions — surged to record highs. But with fears of a recession growing, “workers are showing a little less swagger.” The labor market remains tight, but the days of job prospects “Zooming into interviews with a confidence bordering on arrogance” may be ending. Layoffs are already beginning to tick higher, particularly at tech startups where funding has dried up. Workers are also looking for stability; taking a new job can “be risky in the event of a downturn.”

U.S. dollar continues to surge

A surging dollar means that “now is the most affordable time for Americans to travel to Europe in decades,” said Tristan Bove in Fortune. “One euro is now worth around $1.04,” having fallen in value by more than 9 percent since January because of the war in Ukraine and Europe’s growing trade deficit. The dollar, meanwhile, has been “bolstered by its status as a safe-haven currency” during the economic uncertainty, and the currencies could soon reach parity for the first time since 2002. That will make travel in Europe cheaper than normal this summer. However, there is a catch: Getting there is going to cost you. Soaring airfare means round-trip flights between New York and Paris are routinely more than three times as expensive as they were in 2019.

Rolling over a small 401(k)

Job-hopping can lead to one of the worst financial mistakes you can make, said Suzanne Woolley in Bloomberg. Ninety-eight percent of companies will automatically cash out your 401(k) if the balance in the account is less than $1,000 when you leave. If you don’t roll that money into a new employer plan or IRA within 60 days, you “face a 10 percent penalty, owe income tax — and lose the benefit of that money compounding, tax-free, for decades.” Up to $5,000, the money will usually get rolled over into an IRA, leaving you with another account to keep track of — even if you have a 401(k) at your new job. As one solution, Vanguard is working on a system for employers that would “automatically transfer 401(k)s from one company to another.”

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

Here are three of the week’s top pieces of financial insight, gathered from around the web: A short era for worker power Workers feel their leverage is starting to slip away, said Callum Borchers in The Wall Street Journal. Stimulus checks, a soaring stock market, and remote-work flexibility contributed to an extraordinary amount of employee…

Here are three of the week’s top pieces of financial insight, gathered from around the web: A short era for worker power Workers feel their leverage is starting to slip away, said Callum Borchers in The Wall Street Journal. Stimulus checks, a soaring stock market, and remote-work flexibility contributed to an extraordinary amount of employee…